Do you adapt global pharma commercial strategies to local markets or vice-versa?

Omnichannel newcomers may be surprised to discover a conservative, bottom-up deployment has drawbacks.

“There ends up being a tendency to want to pilot AI solutions for a given brand in a given market,” says Aktana’s Product Director Rakan Sleiman. During Aktana’s recent Omnichannel AI Masterclass he spoke with Veronica Onisoara, Customer Engagement Manager – Europe+, from LEO Pharma, which took a more flexible approach to AI-driven omnichannel adoption.

Watch Aktana and LEO Pharma’s Omnichannel AI Masterclass Session on demand.

What’s wrong with a one-brand, one-market strategy? Surely, it’s a reasonable life sciences commercial tactic. By showing value for the omnichannel solution in the local market, it can be repeated for another brand in the same market, until all the brands are enabled for that market, that region, the next local market, the next region and so on.

However, companies are now recognizing it’s a slower approach to work from local markets up to the global level. These conservative implementations muddy the deployment and limit HCP engagement.

“This can be cost prohibitive,” says Sleiman. “You end up rebuilding a lot of the data pipelines.”

LEO Pharma took the opposite approach to digital transformation by defining their global commercial strategy first. The global strategy allows efficiencies to cascade down to different regions and individual markets.

Now, in one to two months, LEO Pharma is outpacing the benchmarks that conservative deployments realize in three to six months.

Eager to replicate LEO Pharma’s results? Read on for 6 guidelines to build flexibility into your commercial strategy.

1. Leverage the same CRM provider and data systems

“This may sound obvious,” says Sleiman, but we have worked with organizations in the past who have a homegrown CRM in one place and another CRM in another market. “You really do want to try and standardize your CRM.”

Don’t let different data models hold you back from a global approach. Standardize.

Wherever possible, put all your regions on the same marketing automation system, event management system, service pipeline, sales data pipeline, technology stack and data warehouse. Naturally, you can have different instances, but each instance will benefit by using the same global configuration. This crucial detail simplifies data sharing and access across users and regions.

Along the same lines, consolidate and integrate those data systems when you can. “Bringing the two worlds together as close as possible gives a better user experience,” says Sleiman.

LEO Pharma underscores this guideline. “We have a high focus on a fully integrated ecosystem,” says Onisoara. “That enables the orchestration of seamless HCP experiences and the cross-channel engagement journeys.”

As a first step, LEO integrated Aktana’s Contextual Intelligence Engine. The AI solution has already produced 78% engagement with field sales (versus a benchmark of 60-70%) and 48% acceptance of next-best-action suggestions (benchmark: 30-50%) in the U.S. The program is being rolled out across LEO Pharma’s key European markets this year.

2. Align on common data requirements

“Illness really has no borders,” says Sleiman. “When we think about this in the context of a specific brand strategy, the one true common denominator that exists as you move between regions and into individual markets is the product itself. This could be the drug at a molecular level or a medical device. They’re all ultimately treating the same target patients or the same symptoms.”

Although markets have unique requirements, many fields and attributes are the same. “You will start to see that these data points actually are valuable to other brands within the market itself or across markets,” says Sleiman.

Critical data points cross-pollinate globally. These attributes may include the account type, specialty, speaker skills, event status, segment or key messages.

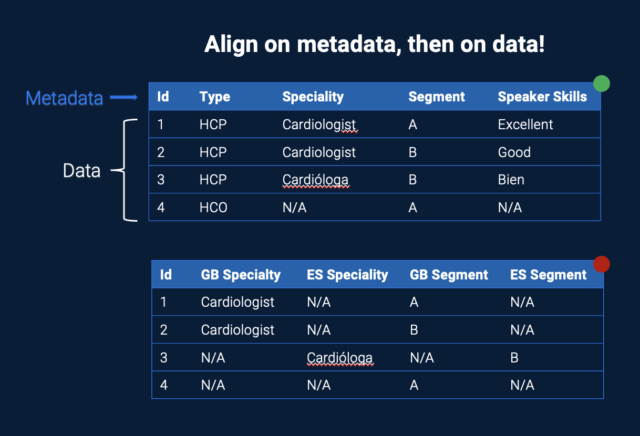

“Start thinking of alignment first on metadata and then on data,” says Sleiman, pointing to Figure 1, below. The top table is an excellent example of how to use a single field (ID, Type, Specialty, Segment, Speaker Skills) to understand customer attributes globally.

Figure 1: Metadata fields should be standardized for global data attributes.

The table on the bottom of Figure 1, the poor example, shows “a different field per market or even per product,” with multiple fields accounting for similar data points (GB Specialty, ES Specialty). “It becomes much harder to assess and use and leverage [this] data, as you’re trying to execute on your brand and strategy,” says Sleiman.

Onisoara echoes the priority of aligning the metadata. “The driving reason to implement such a tool was that in a market like the U.S., we saw a very clear link with the sales performance, of course, because of the granularity of the data.” Even now, early in the game, LEO’s common data requirements are supporting the establishment of “clear frameworks for planning and dashboards, to measure impact and to provide actionable insights across the organization.”

3. Embrace differences

Constraints are real. They’re the reason life sciences organizations often take a bottom-up approach, but if you want a flexible, global pharma commercial model, “you have to allow for them,” says Sleiman. “Otherwise, it just won’t work.”

Your data model should embrace common and known market differences.

Common differences may include HCP preferences, channel availability, content availability and patient preferences. Known differences may include cultures, languages, marketing authorizations, regulations, data availability and enabled technologies.

Figure 2: Agree on common and known differences and allow for them.

It’s a lot to account for, but “you do need to have the right data model and technologies to allow you to manage these variations,” says Sleiman.

LEO is already seeing benefits from the approach. “The omnichannel channel engagements are now integrated locally in the customer journey model, combining global but also local insights and principles,” says Onisoara.

4. Enable all communications channels (but offer a clear opt-out strategy)

Don’t let technology be a blocker. “I joke all the time,” says Sleiman. “Two weeks ago, I was in San Francisco speaking with my five-year-old daughter on a video call. Across all age demographics, people are comfortable using different kinds of channels to communicate.”

With all your channels enabled, focus on consent capture, “so you can actually engage with an HCP through a virtual call, if that’s the channel you’re trying to engage with them,” says Sleiman. “Channel without consent is meaningless.”

Next, create channel-appropriate content. “If you don’t have the right content to leverage on that channel, the channel will not be adopted,” says Sleiman. “Understand your HCP preferences. Some HCPs want digital engagements. Others prefer face-to-face communication.”

“And then finally,” says Sleiman, “let’s not forget about the users . . . the actors, the field team potentially, the people who are helping execute on your strategy.” You may have a field team that’s not ready. “They don’t want to use virtual calls. They don’t want to engage digitally. You need to understand this, and in understanding this, you can set the right change management in place or training and onboarding.”

Figure 3: Enable all execution channels with an opt-out strategy.

Onisoara also stresses that point. “It is essential to build a solid internal communication plan and involve all relevant functions within the project from [the] early stages of launch. I would say that practice and patience are key elements in the first two to three weeks.” This ensures the tool benefits are explained well and stay embedded in the daily workflow of the sales reps.

“Fairly quickly, the teams have embraced the system and benefited from the application. . . . the first results are very encouraging, as the [engagement] rate is higher than the benchmark, with 78% seen monthly, compared to the usual benchmarks, at around 60 – 70%.”

Let channel adoption be driven by four areas: consent, content, your understanding of the users and HCP preferences.

5. Embed intelligence into user workflows

“It’s very clear that the right user experience truly does drive engagement,” says Sleiman. You need one application encompassing all sales, digital, channel and engagement insights—not multiple applications.

“All of your markets should be consuming those insights in the same place,” as in Figure 4, by default.

Figure 4: UX impacts engagement. Leverage one-off development efforts that cross-pollinate between markets.

Let any differences be data-driven needs.

LEO’s Account Insights page follows suit with a “one-stop-shop” for sales reps, which offers “a complete view on the main interactions and sales considerations” by doctor, says Onisoara. For example, reps see a doctor’s potential alongside the doctor’s engagement responsiveness.

Freeing up time spent bouncing between dashboards, reps access the information faster and pre-call planning has improved. The results are evident in terms of “better knowledge about healthcare professionals’ interactions, MSL talks, emails clicked, events attended and brand sales.”

While it can take more effort and discipline up-front to design (and roll out) a “one-stop-shop,” it becomes easier and more cost-effective to leverage one-off development efforts as the project scales.

“Back in Q3 2021, we started to work on building the required core assets needed for this European implementation,” says Onisoara. “Therefore, a standard use solution is currently available for the individual country deployments. And this solution can be running parallel to accelerate time to value, in line with our business needs.”

6. Follow the 80/20 rule (80% standard; 20% custom)

Smart organizations anchor omnichannel data requirements with the 80/20 rule. “You do want to try and start by leveraging standard design 80% of the time, right?” says Sleiman. Minimizing data differences is critical to establishing a global strategy that can cascade down seamlessly into other regions.

“Then allow for 20% customization,” says Sleiman.

Don’t just allow customization, expect it and start to measure it. “It’s absolutely normal. It allows you—with the right governance model—to begin identifying opportunities in that variation.” There may be valuable data there to all the markets within a given region, or even globally.

Following the 80/20 guideline, LEO’s governance model allows countries to “activate use cases from the core library, or they can also propose new ones based on a specific strategic need,” says Onisoara.

In order to launch the program at scale and fast, LEO employs Agile methodologies to collaborate closely with each country and address their needs.

Mission impossible?

If this sounds like mission impossible, take heart. “It’s not mission impossible because we already benefit from the investments done globally in LEO,” says Onisoara, naming Aktana’s next-best-action rep suggestions as a prime example. “We have better coordination between different functions.”

A smart, global-to-local foundation is easier to implement and more effective.

To help your organization cope with rapidly changing market conditions and enhance the HCP experience, use the 6 guidelines highlighted here from the Aktana Omnichannel AI Masterclass. Leverage the common properties of your global brand strategy within local markets, account for known variations and allow cross-brand pollination.